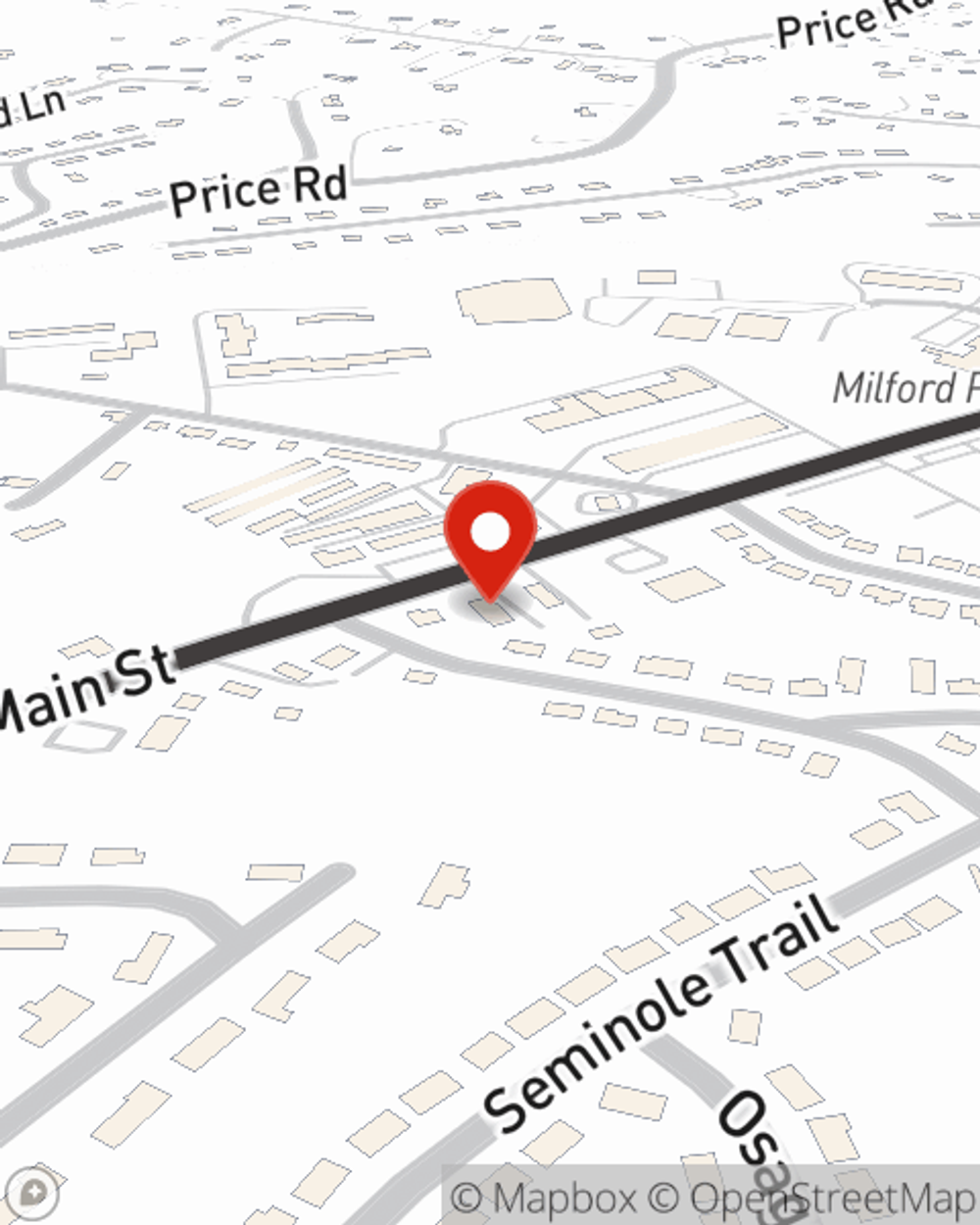

Business Insurance in and around Milford

Looking for coverage for your business? Search no further than State Farm agent Robert Dean!

Helping insure businesses can be the neighborly thing to do

- Milford OH

- Clermont County OH

- Hamilton County OH

- Butler County OH

- Cincinnati OH

- Fairfield OH

- West Chester OH

- Liberty Twp OH

- Loveland OH

- Eastgate OH

- Goshen OH

- Beechmont OH

- Newtown OH

- Batavia OH

- Amelia OH

- Monroe OH

- Lebanon OH

- Deerfield Twp OH

- Terrace Park OH

- Indian Hill OH

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes problems like an employee getting hurt can happen on your business's property.

Looking for coverage for your business? Search no further than State Farm agent Robert Dean!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like extra liability or a surety or fidelity bond, that can be designed to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Robert Dean can also help you file your claim.

So, take the responsible next step for your business and get in touch with State Farm agent Robert Dean to identify your small business insurance options!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Robert Dean

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.